Bitcoin energy usage

Bitcoin mining is driving innovation in the renewable energy sector by incentivizing entrepreneurs and pioneers to develop the cheapest, most cost effective mining systems available.

An example is Upstream Data, a Canadian bitcoin mining company that’s developed products to capture methane emissions and use them for bitcoin mining. This captured energy is typically wasted—either directly released or combusted and released into the air—but now is being used to power decentralized computing networks such as Bitcoin. It’s taking the poison Big Oil has been destroying our planet with for decades—methane, which is far worse greenhouse gas than carbon dioxide—and turning it into an energy innovation that positively impacts our planet. That’s amazing.

This further incentivises entrepreneurs and inventors to explore new opportunity which further fuels innovation and so on and so forth.

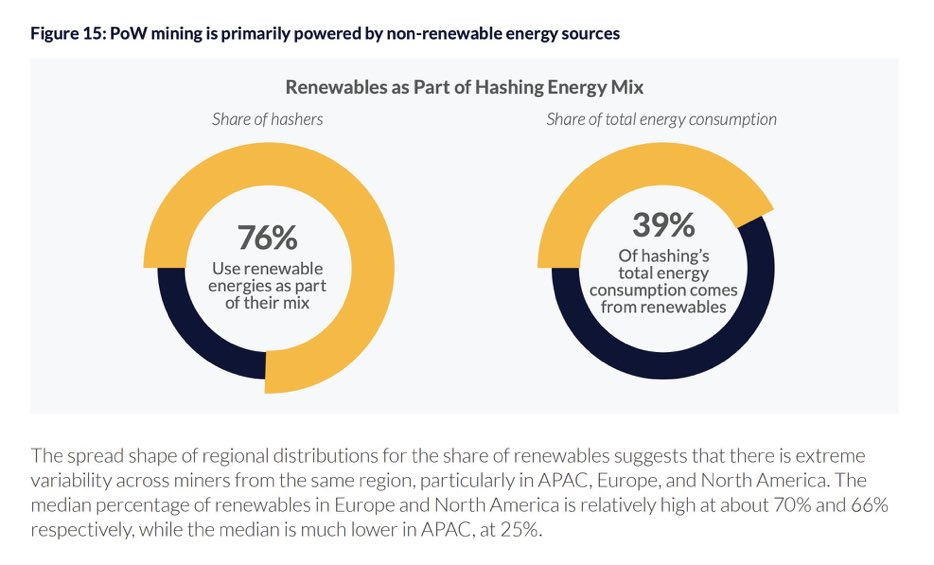

While many people cite that 76% of Bitcoin miners use renewable energy, that’s not entirely correct. Yes 76% of miners use renewables as part of their energy mix, but only 39% of mining comes from renewable sources.

Source: @RyanWatkins (Messari Analyst) + Cambridge Cryptoasset Benchmarking Study

Reading List

- How large scale Bitcoin mining is driving clean energy innovation

- Proof of Work is Efficient — Dan Held

- This power plant stopped burning fossil fuels. Then Bitcoin came along.

Feb 2021

- China (Sichuan, specifically), has lots of hydropower overbuilt over the past decade which would otherwise be curtailed and now is being put to use. It’s a cleaner way to mine bitcoin.

- Sichuan’s installed hydro capacity is double what its power grid can support, leading to lots of “curtailment” (or waste)

- A credit network is a small layer in the whole monetary stack so comparisons are not fair.

- Venmo and Visa are also tiny layers in the broader dollar system.

- Bitcoin is the entire self-contained monetary and payments system on its own—should probably be compared to the entire dollar system. To stretch it a little bit, the US Military is one of the pillars that supports the dollar system and they’re a big consumer of oil.

- Southern provinces of China had built an abundance of hydropower but had not built the infrastructure necessary to transport it to populations.

- American and Canadian companies are mining bitcoin with the otherwise-wasted natural gas produced as a byproduct of oil mining.

- This natural gas is difficult to capture

- It is not economical transport it to populations

- Bitcoin is a geographically independent buyer of energy.

- By capturing the methane released during the oil mining process—a greenhouse gas far worse than carbon dioxide and typically released into the atmosphere—they’re mining bitcoin and having a net positive effect in the environment.

- 85% of miner revenue comes from the issuance of new bitcoin

- We are 88% done with the mining process

- In the future, most miner revenue will accrue from fees

May 2021

How Much Energy Does Bitcoin Actually Consume?

- “Part of the reason Bitcoin consumes so much electricity is because China lowered the clearing price of energy by overbuilding hydro capacity due to sloppy central planning.

- In a non-Bitcoin world, this excess energy would either have been used to smelt aluminum or would simply have been wasted.”

- “Energy is not globally fungible. Electricity decays as it leaves its point of origin; it’s expensive to transport.

- Globally, about 8 percent* of electricity is lost in transit. Even high-voltage transmission lines suffer “line losses,” making it impractical to transport electricity over very long distances.

- This is why we talk about an energy grid — you have to produce it virtually everywhere, especially near to population centers.*”

How much energy should a monetary system consume? Especially one that’s global and decentralized.

Nic Carter: What Bloomberg Gets Wrong About Bitcoin Mining - CoinDesk

- Metrics like the “per-transaction energy cost” are misleading because transactions themselves do not cost energy; nor does bitcoin’s CO2 footprint scale with transactional count.

- Visa transactions are non-final credit transactions that rely on external underlying settlement rails. Visa relies on ACH, Fedwire, SWIFT, the global correspondent banking system, the Federal Reserve and, of course, the military and diplomatic strength of the U.S. government to ensure all of the above are working smoothly.

- It’s worth noting that the grossly oversized U.S. military, whose presence worldwide is necessary to backstop the international dollar system, is the largest single consumer of oil** worldwide**.